In the pursuit of finding the right property, one would usually weigh out certain factors prior to securing a desired home. The inexhaustible question on the minds of prospective homeowners is not knowing what property type to purchase between leasehold and freehold offerings.

For those that are not aware, there are generally two types of titles commonly used for properties established on land parcels and these are leasehold and freehold.

Superior Wealth Mastery founder and chief trainer Alan Poon insights, “The clear difference between leasehold and freehold property is the tenure.

In Malaysia, a freehold property entails perpetual ownership, whereas it is common for a leasehold tenure to stretch up to 99 years before a lease expires and is subject to renewal. In the United Kingdom, for example, a leasehold property tenure may even last up to 999 years.”

“Freehold properties are owned forever by those who purchase it. The owner has all rights upon the property, however, leasehold properties instead are “leased” to purchasers for a predefined period of time.

At the expiring date of a lease, an owner has the choice to renew a lease or return the property to the “actual landowner”. Additionally one should also take note that leasehold properties normally have a 99-year duration,” REI Group of Companies propenomist and chief executive officer Dr.Daniele Gambero echoes.

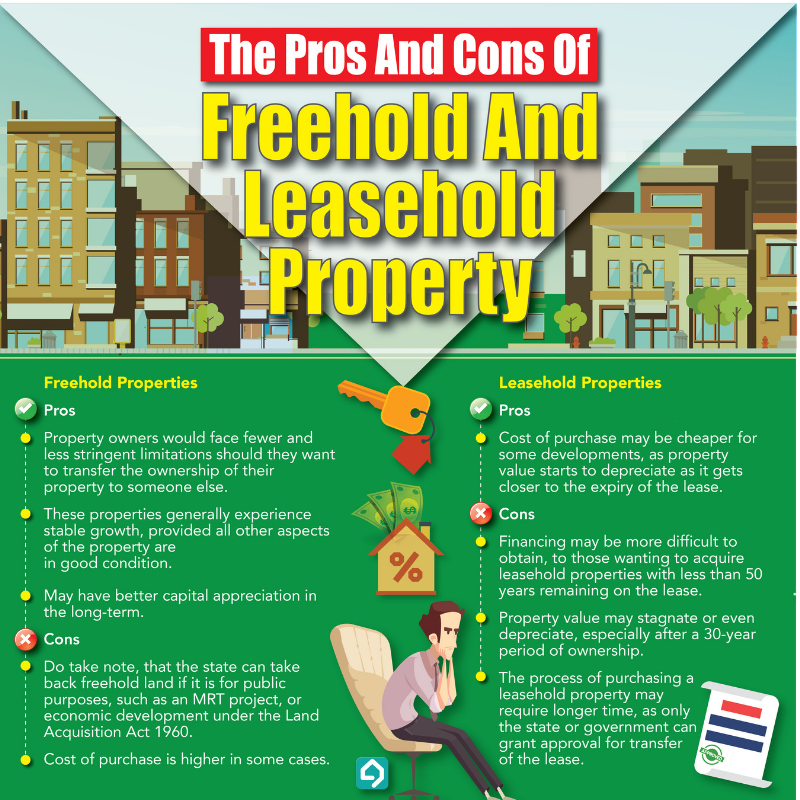

Glance through this simplified infographic, to better understand the fundamentals of leasehold and freehold properties.

REHDA Institute former general manager and property investor David Shieh Chong suggests, “It is wise to ask a developer or agent when you are considering a property, with regard to its land title. If the property is leasehold, always identify the remaining number of years (lease) left when the project is completed or upon vacant possession (VP).”

David adds, “In the last couple of years, I have seen a handful of developments whereby the lease remaining could be 85 years or less upon completion.”

Moving on to the process of purchase, when buying a freehold property, the procedure is pretty straightforward however, Gambero explains, there are cases with leasehold property whereby a vendor may have to request a letter of consent from the actual landowner.

David states, “property buyers should also understand that owners of leasehold properties may need more proceedings with regard to the transfer of ownership from bumi to non-bumiputera owners, thus these tasks may require more time.”

Strengths and Weaknesses of Leasehold and Freehold Properties

With regard to demand, freehold properties commonly face higher demand due to the permanent period of ownership unless; the land needs to be repurposed for the use of highways, Mass Rapid Transit (MRT) or Light Rail Transit (LRT) construction Gambero states.

David explains, “In some situations, the authorities may require the use of your land for instance for certain infrastructure cutting across your property in which the land may need to be acquired under the Land Acquisition Act 1960 however, owners are usually compensated."

Alan tells, “unless the government takes back a freehold parcel of land via the Land Acquisition Act 1960, another way that owners could lose the ownership of their property is via bankruptcy and one’s property subjected to asset forfeiture."

Despite the popularity of freehold properties, many purchasers are opting for leasehold offerings due to key factors such as sale prices and the availability of more leasehold properties with regard to new launches especially in established or central locations that enjoy better connectivity and amenities.

Alan explains, “leasehold properties are ideal to those looking for short term investments as well as to reap the benefits of rental and capital gain due to economic growth. Adding to that, those purchasing a leasehold property in an established area should be more familiar with the surrounding neighbourhood.”

“One should also take note that leasehold properties may not always be cheaper than freehold options as certain factors such as location, product types, construction cost and design as well as demand could cause a leasehold property’s price to spike,” Alan adds.

“In the primary market especially, leasehold or freehold titles don't really impact the value of a property, however, in the secondary market, when the lease left is half or more than half of the total number of years of a lease, it can very well impact transaction values,” Gambero says.

David echoes, “the price appreciation for leasehold properties could be substantially impacted when the lease remaining reduces upon a period of time. When purchasing sub-sale properties whereby a remaining lease is below 70 years, you may find that the valuation of such properties may not improve as much as compared to a similar freehold property within the same area.”

“If you are a home buyer looking to secure a property and upgrade within a period of 5 to 10 years, then there may not be much difference in the ownership of any type of property.

However, those looking for a long term property, ideal for a couple to grow old in, the ownership of a freehold option perhaps may be the best option,” David explains.

“Homeowners that are currently the owners of leasehold properties need not fret as there are cases in which some leasehold land parcels can be successfully converted to freehold title, “ David concludes.

(By Viknesh Ashley Clarence, 23 May 2019)

Did you enjoy reading this article? Do let us know via the comments section below!