With the end of a year full of unexpected surprises and sorrows spearheaded by an internationally notorious political scandal, along with falling oil prices and a slumping currency, 2017 will hopefully be a better, if not, less dramatic year. Here’s to a better 2017, with a sum up of what to expect in the property market this year.

A look back at the 2016 property scene

- Tighter loan approval for buyers of 3rd residential property to prevent speculation.

- Developers are allowed to give loans to buyers, though developers and market watchers remain skeptical about the feasibility of the initiative.

- Announcement of Budget 2017 saw an increase in initiatives to address the problem of affordability and home ownership.

- A reduction of the Overnight Policy Rate (OPR) was announced by Bank Negara Malaysia (BNM), in hopes to spur domestic demand by reducing borrowing costs and helping current loan repayments.

- Completion of the Sungai Buloh-Kajang (SBK) MRT Line 1 spelt excitement not just for the public, but also the property market.

- Plans for Bandar Malaysia and the subterranean KL Terminal were announced, spurring a flurry of excitement for property investors given the extensive new commercial and residential developments within the mega project.

Conclusion of 2016

- Mismatch of supply and demand is seen in the increasing demand for affordable housing, but an oversupply of homes which do not cater to that requirement.

- Negative sentiments towards the Malaysian property market and economy due to the weakened Malaysian Ringgit and political scandal.

- Slow and softened property market.

Source: NAPIC

- The challenging market is further demonstrated by the decreased loan approval rate, at just 41% in the first half of 2016, compared to 51.8% in the same half of 2015.

Source: Bank Negara Malaysia (BNM)

Source: Bank Negara Malaysia (BNM)

What to expect in 2017

With the prospect of a continual weaker Ringgit and lack of major policy changes, the property scene of 2017 is expected to be sluggish, as seen in 2016, though with revived potential in developments focused on rail connectivity, mass market housing and Greater KL.

Market trend

1. Continual flat-line

There will be a plateau in property value and prices, mainly due to the lack of market-changing or major policies, added with the weak ringgit and oversupply of homes that do not meet the demand of affordability.

A report on the first half of 2016 by NAPIC shows a 30.7% increase in the volume of residential overhang and a 51.3% surge in value amounting to RM7.59 billion, with a total of 13,438 units as compared to the same H1 of the previous year.

Source: NAPIC

Developments

1. Restriction of new launches

To ease the oversupply of properties in the market, new launches have been cut back, as seen in the sharp drop of 23,112 units in the third quarter of 2016, compared to the same quarter of 2015, which saw 53,357 units. This trend of pulling back on new launches is expected to remain in the year of 2017.

2. Mass-market properties the way to buyers’ hearts

With the focus on quality over quantity now, more mass-market residential developments falling within the affordability of middle-income Malaysians are expected, with developers beginning to see the importance of targeting the needs of genuine home buyers rather than speculators and foreign investors as seen in prior years.

A report by CIMB Equities Research states, despite the conclusion that sales may remain repressed in 2017, mass-market residential developments will be on the contrary, given the prominent demand coupled with insufficient supply of these properties throughout the years.

3. Greater KL, better prices

Soaring prices of properties in the KL city centre have also prompted homebuyers to turn to Greater KL, in areas like Shah Alam, Sungai Buloh, Rawang, and the likes. Property prices of developments in Greater KL are comparatively lower, while road and rail connectivity will enable buyers to live on the peripheries of the city and commute to work on a daily basis. With that, developers are increasingly concentrating on the suburban towns of Greater KL.

Source: Department of Statistics

Some notable developments in Greater KL include:

- M Residence 1 and M Residence 2 (Rawang)

- Lakeville Residence (Kepong)

- D’Sara Sentral (Sungai Buloh)

For more information on developments, demographics and more within the towns of Greater KL, check out the Neighbourhood Review page on PropSocial!

4. Jumping on the train of rail connectivity

More transit-oriented developments can also be expected, with work to begin on the Sungai Buloh-Serdang-Putrajaya MRT Line 2, along with the announcement of the High Speed Rail (HSR) project connecting KL to Singapore.

Some notable transit-oriented developments which boast proximity to public rail transportation include:

- D’Sara Sentral (Kampung Selamat Station, MRT Line 1)

- SqWhere(Kampung Selamat Station, MRT Line 1)

- Tropicana Gardens (Surian Station, MRT Line 1)

- Sunway Velocity (Cochrane and Maluri Interchange Station, MRT Line 1)

- Pacific Place (Kelana Jaya Station, MRT Line 1)

- Glomac Centro (Kelana Jaya Station, MRT Line 1)

Financing

1. Ease on loan approval and increased initiatives to help first-time homebuyers

Getting approval for loans has been an issue in 2016, along with the lack of appropriately priced properties suited for most property buyers. As such, Budget 2017 also saw the introduction of efforts to cut down on loan rejection rates, with emphasis on first-time home buyers.

According to Budget 2017, loans of 90% to 100% will be much more attainable now, where Malaysians with an income of RM3,000 a month could get a loan of RM295,000 or more, compared to the current RM187,000.

There are also initiatives designed to help first-time homebuyers, as tabled in Budget 2017:

- Urban youth housing

- MyBeautiful New Home

- People’s Friendly Home (PMR)

- People’s Housing Programme (PPR)

Weak Ringgit and oversupply offers a silver lining- for some

1. The lure of having “big” money

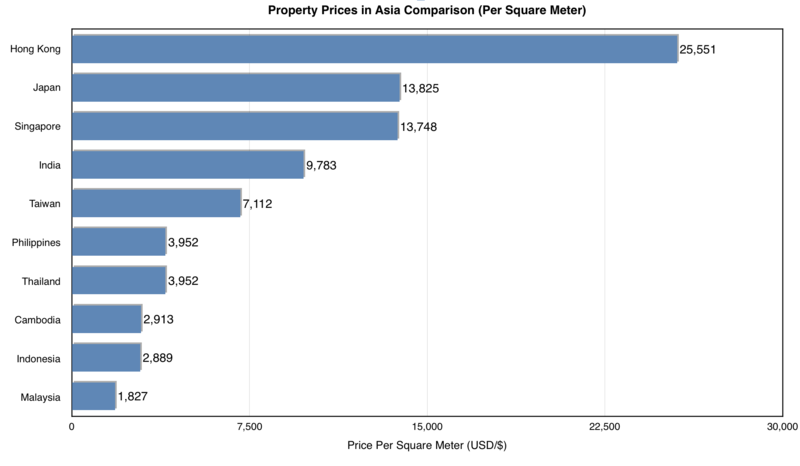

Regardless of the flailing Ringgit, Malaysia remains the go-to for foreign investors, where property prices remain comparatively lower than its other Asian counterparts, giving investors and expatriates alike, more square meters for their money.

Source: Global Property Guide

Major infrastructural plans and townships have also been a catalyst for foreign investment into Malaysia, such as the Bandar Malaysia development, the High Speed Rail (HSR), Iskandar Malaysia projects and so on, a point of attraction for foreign investors.

2. Getting more value for money

2017 will be the time to buy and rent, given the pressing need for developers to sell and avoid a handful of overhang while owners seeking ways to cushion their loan repayments through renting, face heightened competition to find tenants.

As seen in 2016, efforts to encourage sales are expected to continue, where developers offer incentives and attractive packages to buyers, such as rebates, discounts, as well as taking on the expense of legal fees on the SPA and housing loans- all great news for buyers.

For you first-time buyers reading this, check out the 5 “VIP” (Very Important and Painful) Property Taxes that you should know !

Those looking to rent may also find themselves “spoilt for choices”, where rental rates may be much lower as owners vie for tenants by offering attractive rental rates. A market report on H1 of 2016 by NAPIC also states that “current challenging economic environment with slower business expansion, the rental market is expected to experience downward pressure”.

3. Gearing investment towards the right direction

Though sentiments of the property market is generally stale in 2017, investing and gaining good returns from investment is still possible, as long as focus is placed in the right area. Properties with good connectivity close to commercial hubs and educational institutions will be a better bet for investment.

NAPIC reports that in H1 of 2016, upward movements were recorded in developments which are transit-oriented and transit-adjacent, where “those located along the Light Rail Transit (LRT) and Mass Rapid Transit (MRT) route as well as those nearby higher learning institutions and commercial centres gained rental advantage”.

Conclusion - Slow and steady 2017

Despite a softened property market in 2016 “trailing from the challenging economic and financial environment both on the local and global front” as explained by NAPIC’s report, 2017 is surmised to be a flattish year with not too prominent ups and downs (which could be a good thing depending on how you see it).

There is also potential for an improved market, where NAPIC reports of an estimated 4% to 5% growth of the country’s Gross Domestic Product (GDP), in light of the improving prices of commodities like oil and gas.

Source: tradingeconomics.com from Bank Negara Malaysia (BNM)

On another note, most economic and real estate experts anticipate that the Malaysian property market may only begin to pick up in the third quarter of 2017 or 2018- only time will tell if they are right.

Want to hear what experts have to say about the property market in 2017? Check out PropSocial’s Events page to stay up-to-date on all forecast seminars and talks!