The new version of Sales and Service Tax (SST) has gotten into gear starting from September 1, 2018. The re-introduction of SST 2.0, as a substitute for GST that was set at 0 percent rate earlier in June, officially marked the end of the ‘tax holiday’ in Malaysia. Now that we are back on track with the tax train, again, there’s mixed reaction from the public who at the same time, are expressing their concern over potential price hikes on retail goods and services.

Contrast to this, we believe SST is a more preferable tax system by taking into account how it compares in terms of the basket of goods and services listed, including initiatives taken to improve its implementation. So, how is it better, you may ask?

SST vs GST

Let’s start from the top. Basically, Sales and Service Tax (SST) is a tax that is imposed on one level of production, which normally happens at the output level, where goods are being taken out from the factory. In a simpler word, it means that the tax affects only manufacturers and importers in the supply chain and would have minimal impact on consumers as it is implemented only on a single-stage.

Meanwhile, for services, the tax is applicable to certain services offered to consumers. Services that are taxable include those provided by hotels, insurance firms, gaming outfits, telco companies, and professional services such as lawyers and accountants.

In comparison, Goods and Services Tax (GST) is a consumerism tax based on the added-value concept on each level in the supply chain, from production to consumer. It is imposed on goods and services at every level of production and distribution in the supply chain, including exported goods and services.

The SST 2.0 at A Glance

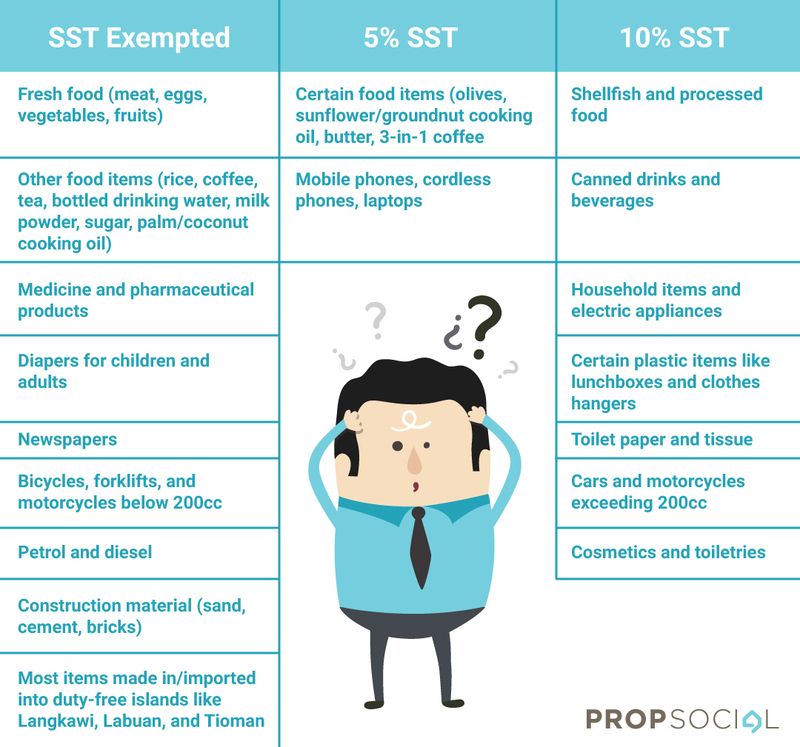

Now for SST 2.0, the tax rate is set between 5 to 10 percent for sale of goods while for services is levied at 6 percent. Yes, this rate is more than the flat rate of 6 percent during the time of GST, BUT! The number of taxed items and services are reduced greatly under SST. According to Finance Minister, Lim Guan Eng, SST would only be applicable to 38 percent of the Consumer Price Index’s basket of goods compared to the 60 percent under GST. Adding on, a total of 5,443 consumer items have been exempted from SST, approximately 10 times more than under GST.

List is sourced from Royal Malaysian Customs Department

Based on the list above, the government’s move to re-implement SST with the exemption of these several essential products and services are expected to benefit mostly those who are in the B40 category (earning a monthly income of below RM3,000) plus, considering the large middle-class population of the nation.

“In the short-term, there might be a slight impact on the prices of goods and services but the price rise will not be big enough to burden the people,” opined the Federation of Malaysian Consumers Associations of Malaysia (FOMCA) advisor, Datuk Prof Mohd Hamdan Adnan.

Good News for SME, Startups, and Micro-Businesses

Similarly to GST, businesses and services are also taxable at 6 percent under SST 2.0. Specifically, the service tax is chargeable to businesses with an annual revenue exceeding RM500,000 a year. Additionally, for food and beverage outlets, the service tax is only imposed when the annual revenue is over RM1.5 million. This is definitely good news to all the Small Medium Enterprises (SMEs) and micro-businesses out there with annual revenue lesser than stated.

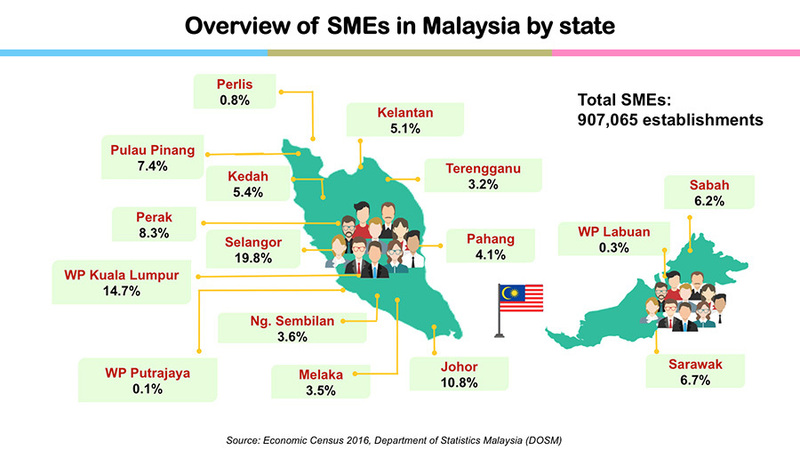

Following to a recent report by MIDF Research, companies with annual revenue of over RM500,000 are taxable under SST 2.0 and due to this higher threshold of annual income, not more than 20 percent of SMEs in Malaysia will be affected. To date, out of 907,065 SMEs in Malaysia, 693,670 or 77 percent are considered micro enterprises, which have annual turnover of less than RM300,000 and less than five employees.

“About 85 percent of businesses will be out of the tax net which will help to reduce prices as the micro-businesses and SMEs will not be burdened by taxation,” clarified the Custom Department deputy director-general, Datuk Seri Subromaniam Tholasy. He also added that the compliant cost for businesses under SST is also lower, thus, helps to lower the nett price of goods.

Keen Government Initiatives for Better Implementation of SST 2.0

On another positive note, the government is keen in taking proactive measures to ensure a smooth implementation of the new tax system. According to the Finance Minister, the government would listen closely to the public's response and complaints over issues pertaining to SST and appropriate measures will be taken.

“We will study all of these. We have been going around listening to feedback from the people. Some are asking that certain items affected by the STT be taken off the list. As a concerned government, we will do the needful. Be patient. Give us some time and we will make the necessary changes by year’s end,” said Lim Guan Eng.

Additionally, the Domestic Trade and Consumer Affairs Minister (KPDNHEP) is also on board by setting up an operations room for the public to lodge complaints and make enquiries in order to avoid profiteering and overcharging by businesses. The public is reminded to submit complaints with clear details, such as the name and address of the venue the complaint is about, details about the goods and price, as well as receipts for them to investigate.

Those who wish to lodge a complaint or suggestion can drop a call to KPDNHEP toll-free line at 1-800-886-800.

Conclusion:

On a parting note, it has only been less than a week since the implementation of SST 2.0 for us to fully assess its impact. More time is needed to understand how SST will affect the nation’s domestic consumption and how it may influence price of goods and services. The outlook is positive given that the government is keeping their promise to iron out the creases and crinkles in the implementation of SST 2.0 for the benefit of all.

Let us know your opinion on the new SST implementation. Drop your comment below and check out other interesting articles on our Discussions page.

(Written by: Aisyah Shukor, 4th September 2018)