Is it your dream of owning an investment property that will provide a steady stream of income? If yes, we listed five main challenges involved that could derail a lucrative Return on Investment (ROI). We also shared some financial advice to tackle such risks.

1. Property Prices Don’t Always Go Up

Some people think that you’ll certainly get rich if you invest in property as home prices continue to increase each year. However, that’s not necessarily the case as property values rise and fall depending on different factors.

Having knowledge of these negative and positive factors is important in becoming a savvy investor, but it takes a considerable amount of effort and time to get a good grasp of Malaysia’s real estate industry.

Nonetheless, the golden rule of property investing is easy to memorise as it’s just “location, location, location!” The phrase means you need to look into the place before committing to purchase, as there are areas where many want to live in, while there are also sites that people tend to avoid. Ideally, you should buy a house in a desirable location as property prices there are more likely to see strong growth as compared to the latter.

For example, property values in Malaysia’s capital Kuala Lumpur have soared by nearly 122 percent from 2005 to 2015. In comparison, average home prices across the country only increased by 96.1 percent over the same period based on government statistics.

The strong gains may encourage you to invest, but please note that such values are significantly influenced by political and economic factors. For instance, home price growth in Malaysia had slowed down or contracted during the 2007–2008 Global Financial Crisis.

Source: globalpropertyguide.com

Hence, you need to be prepared for such occurrences. One thing you can do is set up an emergency fund so you won’t be forced to sell your property during downturns when prices are low.

2. Market Forecasts Can Vary

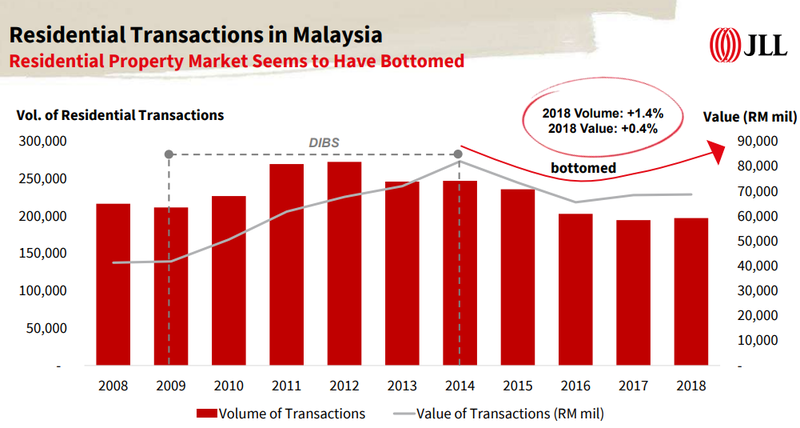

Unless you know someone who can really predict the future, you won’t be sure if property prices or rents will increase or decline over the horizon. As a matter of fact, only a few economists foresaw the 2008 Global Financial Crisis, and fewer still heeded their bleak warning. In Malaysia, many property experts held rosy outlooks before home sales followed a downtrend from 2014 to 2018 as shown in below table:

Source: NAPIC, JLL

Basing your property investment decisions on historical trends is typically a wise move, but keep in mind that price and rental movements may deviate such patterns. For instance, in the above graph, it appears that residential transactions have bottomed out and could rebound in 2019 or 2020. However, it’s possible that this rosy projection won’t materialise and sales could remain flat or decrease in the future.

Essentially, the property industry follows a cyclical trend. Residential prices and rents ebb and flow like the tide. For instance, the property market enjoyed strong growth in 2011 after the financial crisis. But the pace of increase slowed down in 2018 and 2019 due to a substantial supply of completed but unsold houses.

According to a September 2019 report from Malaysia’s National Property Information Centre (NAPIC), the overhang edged up by 1.5 percent to 32,810 units collectively worth RM19.76 billion. And about 43 percent of these units comprised condos priced from RM200,000 to RM300,000 each.

Therefore, if you’re considering investing in real estate, you should take note of the industry’s cyclical trends, particularly the current state of the local property market.

3. Renting out a Property is Not That Easy

Setting up a profitable rental home is not a piece of cake. One common challenge for landlords is finding long-term tenants, who will not only pay the monthly rent on time but also take good care of the property.

You also need to prepare for the possibility that your unit would be left vacant, providing you with zero rental returns. This is important if you will be depending on this income stream to pay off your mortgage instalments.

Another factor you should take into account is property maintenance, as repairs could substantially reduce your ROI, while damages caused by an unscreened tenant could make the home undesirable to other renters. You also need to consider that properties in different places command different rents.

4. High Interest Rate Affects Your Returns

Buy-to-let investors should pay attention to this, as they typically turn to loans to fund their investments.

Unless you’ve obtained a fixed-rate housing loan, where monthly repayments remain constant, those who got an adjustable-rate mortgage (ARM) face the risk of higher repayments if interest rates rise. And this can drag down the earnings from your rental property.

Hence, you need to calculate the maximum monthly repayments you can afford. In case interest rates increase sharply, consider refinancing or switching to a fixed-rate loan as an uptick of single percentage could increase your total repayments by thousands of ringgit.

In addition, it can be hard to get a loan-to-value (LTV) of 100 percent and you would need to pay the difference in the property price from your own pocket.

Thus, have a long talk with your bank. Ask about how much you can loan, the monthly instalments, the overall increase in cost if interest rates spike and other things you need to know, such as lock-in periods.

5. Property is Sometimes an Illiquid Asset

Real estate is a liquid or illiquid asset depending on the prevailing market situation. We say an asset is liquid if it can be easily sold without a significant decline in value. On the other hand, illiquid assets suffer a large drop in price if you sell them quickly.

If the market is sluggish, you will typically need to wait a long time to find a buyer willing to purchase your home at the price you want. You may even need to lower your asking price just to secure a taker. If the industry is sizzling hot, there could be a crowd competing, driving up the price.

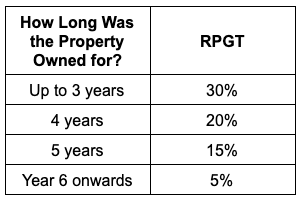

Furthermore, your returns can be negatively impacted by the Real Property Gains Tax (RPGT), a levy sellers need to pay depending on how long they’ve held the property before it was sold and its price appreciation. For details, please see table below:

For more articles like this, visit the PropSocial discussion board.

(Written by G. Zizan, 5th November 2019)