An often-heard argument against (and sometimes for) homeownership is one of asset classes.

Some say, many other financial instruments yield higher returns in shorter time-frames, admittedly at greater risk, than a similar investment in real estate ever could.

The down-payment on a home, some might add, could be put to better use in a fixed deposit, trading currencies, or better yet, the stock market.

An Extreme Example

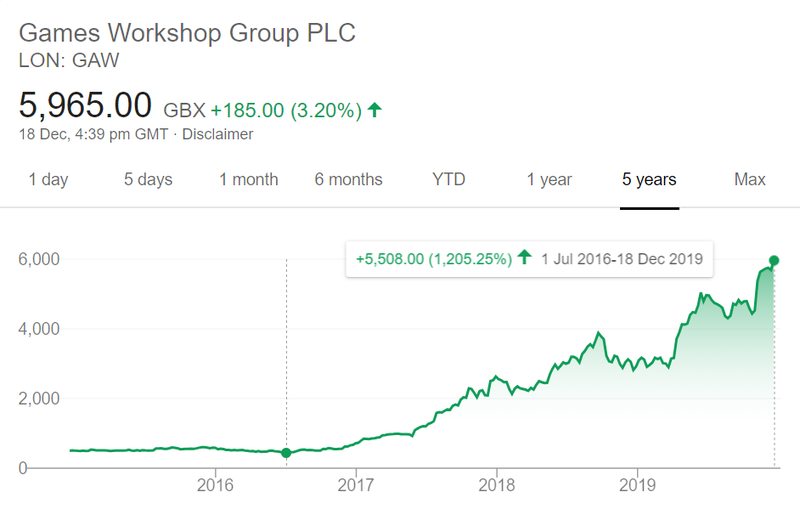

If someone had the foresight to buy into Games Workshop back in mid-2016, their investment would be worth ten times more within just three and a half years.

Not bad for a company that sells miniature models of things they (sort of) made up.

Reality Check: Picking Winning Financial Instruments Is an Art/Science of Its Own

In no way does putting money into publicly traded shares absolutely guarantee higher returns than what could be achieved with rental income or the capital appreciation of real estate.

Unless your real estate looks like this, in which case, go ahead and bet on anything. Photo by Thomas Layland on Unsplash.

This particular form of investment demands constant study and monitoring, while real estate tends to entail less frequent personal attention and significantly lower risk – albeit at the cost of longer periods of commitment.

A Side Note on Games Workshop

Ask 10,000 people to explain what Games Workshop does without googling it and perhaps only one out of 10,000 will not immediately picture Santa’s elves hammering together a Monopoly set.

That one in 10,000 would be picturing something like this instead. Photo by Jack B on Unsplash.

The folks at Games Workshop created a series of table-top games that makes Monopoly look like Snakes and Ladders, and while at least one in ten people have ever been forced to play Monopoly at some point in their lives, only one in 10,000 still actively partake in the expensive pastime of Warhammer, or its larger offspring, Warhammer 40k.

Warhammer 40k is a sprawling fictional universe comparable in depth and scale to A Game of Thrones, The Walking Dead, The Lord of the Rings, and The Chronicles of Narnia – ‘combined’, that one person in 10,000 would add.

There Might Be Some Luck Involved in Picking Winners

Games Workshop owns the licenses to what 99.99% of people would consider an expensive hobby, one with a dedicated following of less than a million people around the world.

And yet, a single whole share in this relatively obscure enterprise (GAW) listed on the London Stock Exchange is more valuable than a share in Apple (AAPL) on the NASDAQ – six times more valuable in 2016 and nearly 30 times more in 2019.

Someone new to trading shares might have gone with the visibility of corporations like Apple when deciding on where to put their money. And Apple would have appeared to be a reasonable choice, especially considering that multiple sources cite the figure of 1.4 billion as the number of people currently using an Apple product worldwide.

The other 6 billion of us can only rely on hopes and dreams. Photo by Laurenz Heymann on Unsplash.

But you would have had to sit on that investment for over a decade, from around July of 2009, and hang on with unwavering faith through the passing of Steve Jobs and a new era under the leadership of Tim Cook, in order to see that same kind of increase in value as with the extreme example of Games Workshop.

So, Why Invest in Real Estate?

Because the performance and associated risks of alternative investment vehicles should make anyone without a doctorate in finance sweat a little bit.

Spoiler alert: This is what your world would look like for around 40 hours a week. Photo by M. B. M. on Unsplash.

This observation of two isolated examples in share trading should raise the question of whether any reasonable person can maintain the appetite to forgo making a downpayment on a roof they could live under, in favour of a period of unknowable risk and uncertainty.

The answer for most of us should be a resounding ‘no’. Most sensible people tend to avoid risking hard-earned money in games of chance – which is likely the same reason why you don’t meet a lot of professional blackjack players.

This article is written from the perspective of someone with a superficial familiarity with trading shares, as an extension of the rent vs buy debate among aspiring homeowners. The underlying message here is that buying real estate may yield lower financial returns over a longer period, but the attention required and inherent risks of other asset classes should be a deterrent to the most practical of investors

(Written by Kevin Eichenberger, 9th January 2020)