As a global leader in Shariah-compliant financial products, Malaysia is witnessing robust growth in Islamic housing loans. In fact, Islamic banking grew by 11 percent in 2018, outpacing conventional loans that merely posted an uptick of 3.3 percent. Such loans also accounted for 32 percent of the total lending in the country, based on a report by RAM Rating Services.

But because there are still many home buyers out there who don’t know the difference between an Islamic housing loan over a conventional mortgage, we created this article to shed light on the five most frequently asked questions on the topic.

1. What are Islamic Housing Loans?

A typical mortgage loan charges interest rates, while an Islamic housing loan doesn’t impose riba (interest rates) as Shariah forbids the imposition of such as these are considered unjust, usurious and exploitative gains.

In Malaysia, most Shariah-compliant housing loans are provided under the Bai Bithamin Ajil (BBA) concept, wherein the home buyer will jointly own the property along with the financial institution. The buyer then purchases the bank’s share in the property. Once you’ve bought the entire share of the bank, the property will be conveyed to you through a gift transfer (Hibah).

Basically, there are three ways in which an Islamic housing loan is transacted to make sure the gains made from the deal is not deemed haram (forbidden by Islamic law):

I. A sale contract (BBA) wherein the financial institution sells a property to a client, who makes deferred payments in instalments or lump sum.

II. A partnership (Musyarakah) agreement in which the bank and client jointly purchase a property and co-own it. The client commits to make progressive payments until he or she fully acquires ownership of the residential property from the financial institution.

III. A leasing (Ijarah) deal, by which the bank will act as the property owner and lease it to a client, who will pay rent for the property. But at the end of the leasing tenure, the customer will be given the right to purchase the property.

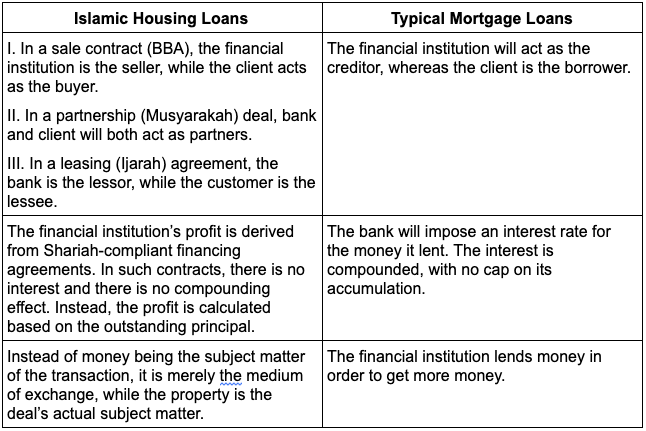

2. Differences Between Islamic Housing Loans and Conventional Mortgages

Source: Maybank

3. Perks and Disadvantages of Islamic Housing Loans

Source: Maybank

However, please note that Islamic housing loans have disadvantages as well.

I. For instance, clients face additional cost when they restructure their mortgage, change the terms of their agreement, or opt for a new loan contract.

II. Customers could also pay more for legal fees as there are more documents involved in an Islamic housing loan as compared to a typical mortgage.

III. Terms including those pertaining to defaults, late payments or early settlements could be opaque versus those in a conventional housing loan.

4. What Should I Watch Out for When Applying for Islamic Home Financing?

Penalty for Late Payment

Although Islamic housing loans don’t impose interest, penalties for late payment differs per financial institution. As such, it’s vital to know how much your bank charges.

Lock-in Period & Exit Penalty

For Islamic financing, most banks don’t impose lock-in periods. However, there are some financial institutions that do, so it’s best to check your contract as the exit penalty or fee for breaching lock-in periods is quite substantial.

Legal Fees

Compared to typical mortgages, Islamic housing loans involve different documents such as a Sell and Buy Back Agreement. If you’re unfamiliar with such deals, engaging an attorney can assist you in explaining the terms and jargon in these contracts. However, the legal fees that you need to pay will likely increase by about 10 percent due to the added documentation. Moreover, the government has terminated its prior scheme of offering a 20 percent stamp duty exemption on Islamic housing loans.

Property Usage Must be Shariah-compliant

Under some Islamic financing contracts, the purchased property cannot be used for immoral activities or those considered haram (forbidden by Islamic law). While this is not an issue for houses, there could be problems for commercial properties, particularly those that would be used as shops selling alcohol and liquor. As such, it’s ideal to check on what activities are deemed to be non-Shariah-compliant by your bank.

5. What do I Need When Applying for Islamic Financing?

The application procedure for such loans is similar to a typical mortgage, and the documents you need to submit to the bank include the following:

- National Registration Identity Card (NRIC)

- Copy of Property Title

- Valuation Report (for completed properties)

- Copy of Letter of Offer or Booking Receipt from Property Developer, or the Sales and Purchase Agreement

- Latest salary slips for three straight months

- Latest commission statements for six straight months

- Latest EPF statements with transaction history of at least three consecutive months

- Latest bank statement for six months or latest EA form (your annual remuneration statement)

- Letter confirming employment and remuneration

Notably, you can apply for Islamic home financing even if you’re not a Muslim. For Muslims, obtaining such loans means complying with the Shariah, which prohibits the imposition of interest. For people of other faiths, this means having alternatives to a conventional housing loan.

Whether it’s an Islamic housing loan or a typical mortgage, the most important thing to always do is to shop around and compare the different loan packages available in the market. This is to make sure that the loan you’re applying for is not only suited to your needs but is also within your means.

For more guides like this, visit the PropSocial's discussion page.

(Written by G. Zizan, 3rd January 2020)